heloc draw period vs repayment period

The loan term that. Draws are not permitted during the repayment period.

Draw period of 10 years plus 1 month Repayment terms up to 20 years.

. A draw period during which you can borrow against the line of credit as you wish and a repayment period during which you must repay the money youve borrowed. A HELOC has two phases. A home equity line of credit HELOC is another option for using home equity to purchase a new home.

The draw period and repayment period. To refinance or pay any First. Also like a credit card you can draw from and pay back into it whenever you want.

In this type of refinance you simply take out a home equity loan and use it to pay off the balance on the HELOC as a single transaction. You have to be prepared for this or the increase in your monthly payment which will now include principal as well as interest could catch you by surprise and hurt your. A HELOC works like a credit card allowing you to pull funds when you need them and pay them back after the draw period ends.

Some lenders require borrowers to pay back the entire amount at the end of the draw period and others may allow you to make payments over another time. Borrowers are pre-approved for a. HELOCs are usually set up as adjustable-rate loans during the draw period but often convert to a fixed-rate during the repayment phase.

HELOCs are similar to home equity loans but instead of receiving the loan proceeds upfront you have a line of credit that you access during the loans draw period and repay during the repayment period. The minimum draw is 300 except for in Texas where the minimum draw is. Most HELOC rates are based on an index and margin that can change with financial markets during the draw and repayment period.

You also wont be able to make interest-only payments. Draw period repayment. HELOCs have variable interest rates but some banks let you lock in a.

Home Equity Line Of Credit - HELOC. Knowing the ins and outs of both products will help you choose the right type of home equity financing for home improvement projects or other financial goals. A HELOC lets you borrow and repay as you wish during the draw period of up to 10 years before you have to being repaying principle.

HELOCs typically have a draw period of up to 10 years and a repayment period of up to 15 years beyond the draw period. The draw period during which you can withdraw funds might last 10 years and the repayment period might last another 20 years making the HELOC a 30-year loan. Pros and Cons Home equity loans and lines of credit extract value from your home.

It cannot be used for the following among other prohibitions. You might be able to pay only the interest due on the amount you draw each month. Our rate table lists current home equity offers in your area which you can use to find a local lender or compare against other loan options.

A HELOC has two phases. The repayment period can be either fixed or adjustable rate. The loan is a lump sum and the HELOC is used as needed.

The Monthly Payment Calculator will calculate the monthly payment for any loan if you enter in the total loan amount the number of months to pay off the loan and the loan annual interest rate. If house values are rising in your neighborhood you may consider using a home equity loan versus a home equity line of credit HELOC to tap some of your growing home equity. Instead youll have to.

HELOC amounts range from 15000 to 750000 up to 1 million in California and repayment periods are available in 10- 15- or 20-year terms after a 10-year draw period. During the draw period you may take funds from your HELOC up to. However interest-only payments only last until the draw period ends.

Home Equity Line of Credit. Rather than having a fixed rate a home equity line of. You dont have to use the same lender that you have the HELOC through.

There are no fees associated with Wells Fargos HELOCs. To illustrate how minimum monthly payments work during the draw period lets say you withdraw 50000 at a 5 percent interest rate using. Fees expenses anything else.

Bank charges an annual fee of up to 90 after the first year unless you sign up for the banks Platinum Checking Package then its waived but you may have to pay a monthly maintenance. Standard HELOCs work on a 30-year model with a 10-year draw period and 20-year repayment period though there are some exceptions. This product can only be used for personal family or household purposes.

When the draw period ends you can no longer borrow money from your HELOC. Most HELOC plans allow you to draw funds over a set amount of time known as the draw period. This method of using equity to buy investment property.

The repayment period typically lasts five to 10 years depending on the terms of your HELOC. There is however no grace period where you wont be charged interest until a certain date the moment you withdraw from the HELOC interest starts accruing. When the draw period ends you.

A HELOC is similar to a home equity loan in terms of working alongside your existing first mortgage but it acts more like a credit card with a draw period and a repayment period and is one of the more popular options with todays homeowners. A HELOC has two important phases. During the draw period you can borrow from the credit line by check transfer or a credit card linked to the account.

The Holding Period Return Calculator is an online calculator that will show you how to calculate the holding period return of a given investment or group of investments. The draw period and the repayment period. At the end of this period you may be able to renew the credit line and keep withdrawing money but not all lenders allow renewals.

2 Personal Line of Credit consists of a two-year interest-only revolving draw period followed by a fully amortizing repayment period of the remainder of the term. A home equity line of credit provides you with a line of credit with a pre-approved limit like a credit card. A home equity line of credit HELOC is a line of credit extended to a homeowner that uses the borrowers home as collateral.

The interest-only repayment option is an attractive feature of a HELOC. Holding Period Return Definition. During the draw period which may last five to 10 years youll use special checks or a credit card to borrow money when.

Leverage Your Home Equity Today. Start by entering in the beginning investment value the ending investment value and any income such as dividends or interest received from the investment. Lower rates and discounts are available for people with eligible Wells Fargo accounts.

Each option can be strategic depending on your own circumstances so understanding more about why. However at the end of the draw period the interest and principal will be rolled into one amortized monthly payment for a loan term of 15 years.

Home Equity Loan Vs Heloc Infographic Discover

Heloc Volume By Origination Eod And Maturity Date Entire Sample From Download Scientific Diagram

What You Should Know About Home Equity Lines Of Credit Heloc Canandaigua National Bank Trust

Heloc Payment Calculator With Interest Only And Pi Calculations Home Improvement Loans Home Equity Loan Heloc

Let Your Equity Work For You Visionbank

Heloc Payment Calculator With Interest Only And Pi Calculations Budget Calculator Interest Calculator Cash Budget

The Difference Between A Home Equity Loan And A Home Equity Line Of Credit Palisades Credit Union

While Closing On Your Dream Home As A First Time Home Buyer In Texas You Might Have Signed Many Documents Wh First Time Home Buyers Home Appraisal First Time

What Is A Home Equity Line Of Credit Heloc And How Does It Work

More Home Loan Options To Increase Your Buying Power Heloc Homeloans Mortgages Crestico Mortgagesmadeeasy Lowinterestrates Home Loans Heloc Loan

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

Can You Get A Heloc With A Bad Credit Score Credello

What Is A Home Equity Line Of Credit Heloc The Wealth Circle

What To Know Before Your Heloc Draw Period Ends Nextadvisor With Time

What Is A Heloc And How Does It Work Prosper Blog

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

What You Should Know About Home Equity Lines Of Credit Heloc Canandaigua National Bank Trust

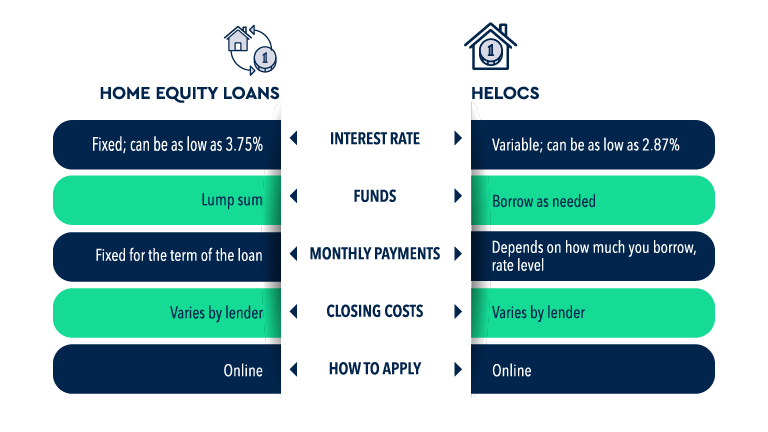

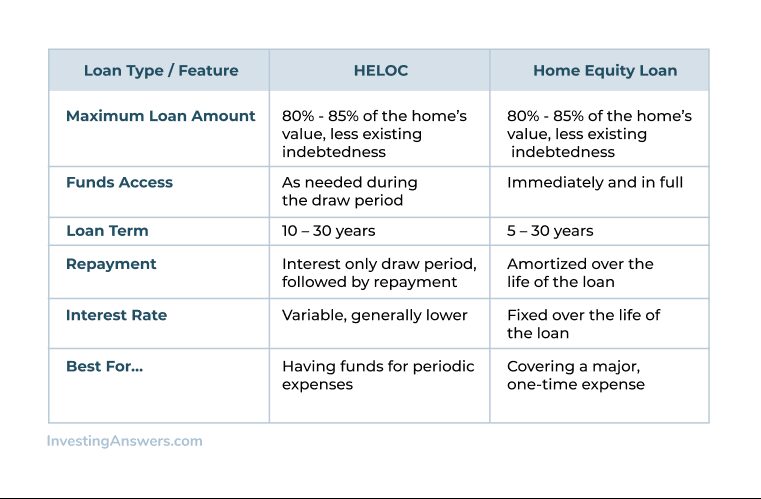

Heloc Vs Home Equity Loan What S The Difference Investinganswers

/shutterstock_188743595.home.equity.loan.cropped-5bfc30d246e0fb00265ce4b2.jpg)