tax liens atlanta georgia

Atlanta GA currently has 625 tax liens available as of July 31. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus.

You can then buy the tax lien property at a public auction.

. When handled properly carefully and systematically tax deed investing can often yield great returns. Contact The Peck Group LC online or call 770-884-6914. Investing in tax liens in Atlanta Georgia is one of the least publicized but safest ways to make money in real estate.

Notice of Intent to Levy IRS Form 668y. Tax Lien Lawyers Atlanta Office Avg. Occupational Tax Licensing and Excise Tax.

Tax lien auctions are conducted on the steps of the county courthouse the first Tuesday of the month. In Georgia the courts have a legal claim against your property called a tax lien when you have unpaid property taxes. However Georgia has many tax deed sales.

Georgia Tax Lien Homes Search all the latest Georgia tax liens available. Just remember each state has its own bidding process. The Department is dedicated to enforcing the tax laws and strives to be fair consistent and reasonable in its actions while collecting delinquent debt.

In Georgia tax deed sales have a right of redemption that pays 20 if the owner redeems. Non-judicial and judicial tax sales. This tool allows for searching for state tax liens and related documents that have been submitted by the Georgia Department of Revenue for subsequent acceptance and filing by a clerk of superior court.

Georgia Tax Liens Find the best Tax Lien deals in Georgia right now -- save as much as 50 percent on a new home. Georgia does not sell tax lien certificates. You can potentially hit the jackpot with a minimal investment in a tax lien resulting in you becoming the property owner.

Contact Our Real Estate Team If you have additional questions about Georgias property tax ownership or tax lien laws please reach out to Brian M. The Peck Group LC has helped many clients avoid tax liens through early negotiation and has helped others with discharge of their tax liens. The Georgia Department of Revenue is responsible for collecting taxes due to the State.

11 250 02 071. Notice of Intent to Levy IRS LetterCP504. In fact the rate of return on property tax liens investments in Atlanta Georgia can be anywhere between 15 and 25 interest.

Douglas Associates at 770 933-9009 or via our online contact page. Notice of Federal Tax Lien. There are more than 7306 tax liens currently on the market.

Atlanta Georgia IRS Tax Lien. Property tax liens are used on any type of property whether its land your house or commercial property. Most Common IRS Forms IRS Letter1058.

Check your Georgia tax liens rules. In Georgia there are two types of tax lien sales. Contact Us Visit Website View Profile 1 Verified Attorney Se Habla Español Free Consultation Bomar Law Firm LLC.

131 2017 decided that a party who redeems a tax deed is not automatically first in line to receive excess tax-sale funds following a tax sale. A property was auctioned at a tax sale and sold for 110000. What is a lien.

Business Hours Office of Revenue hours of operation is Monday through Friday 900 AM until 500 PM. Investing in tax liens in Atlanta GA is one of the least publicized but safest ways to make money in real estate. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Atlanta GA at tax lien auctions or online distressed asset sales.

What if I cannot pay in full by the due date. Until your property taxes have been paid in full the tax lien prevents you from selling or refinancing the property. Search the Georgia Consolidated Lien Indexes alphabetically by name.

Located in Atlanta we help clients in Georgia and nationwide in IRS matters. This is the searchable electronic filing submission docket as provided for by Georgia Code 15-6-973 and is effective January 1 2018. Atlanta Title Company LLC 1 404 445-5529 FEDERAL TAX LIENS 311 In General Marketability of title is adversely affected by the General Federal Tax Lien which is discussed in Sections 312 through 3111 the Federal Estate Tax Lien discussed at Section 3112 a and the Federal Gift Tax Lien discussed at Section 3112 b.

Collections including Liens. The Georgia Supreme Court in DLT List LLC vs. If you live in Atlanta Georgia call us at 8885722179 for a free consultation.

Our real estate team would be happy to help. Delinquent Tax The Delinquent Tax Division of the Tax Commissioners Office is responsible for the collecting of all outstanding taxes that were not paid in full on or before December 31st of the prior year s or by the adjusted due date from an appeal or adjustment. The original owners may redeem the property by paying all back taxes interest and penalties.

The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of Commissioners and other Governing Authorities to calculate taxes for each property and mails bills to owners at the addresses provided by the Board of Tax Assessors. 27 years 770-742-7164 5855 Sandy Springs Circle NE Suite 190 Atlanta GA 30328 The Peck Group LC a reputable Tax Lien firm in Georgia serves the Atlanta area. In fact the rate of return on property tax liens investments in Atlanta GA can be anywhere between 15 and 25 interest.

The process is a little more complicated than in some states. Accounts Receivable Reconciliations. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

Buying tax liens at auctions direct or at other sales can turn out to be awesome investments. The facts of DLT List are straightforward. Brian Douglas on November 9 2021 at 753 pm.

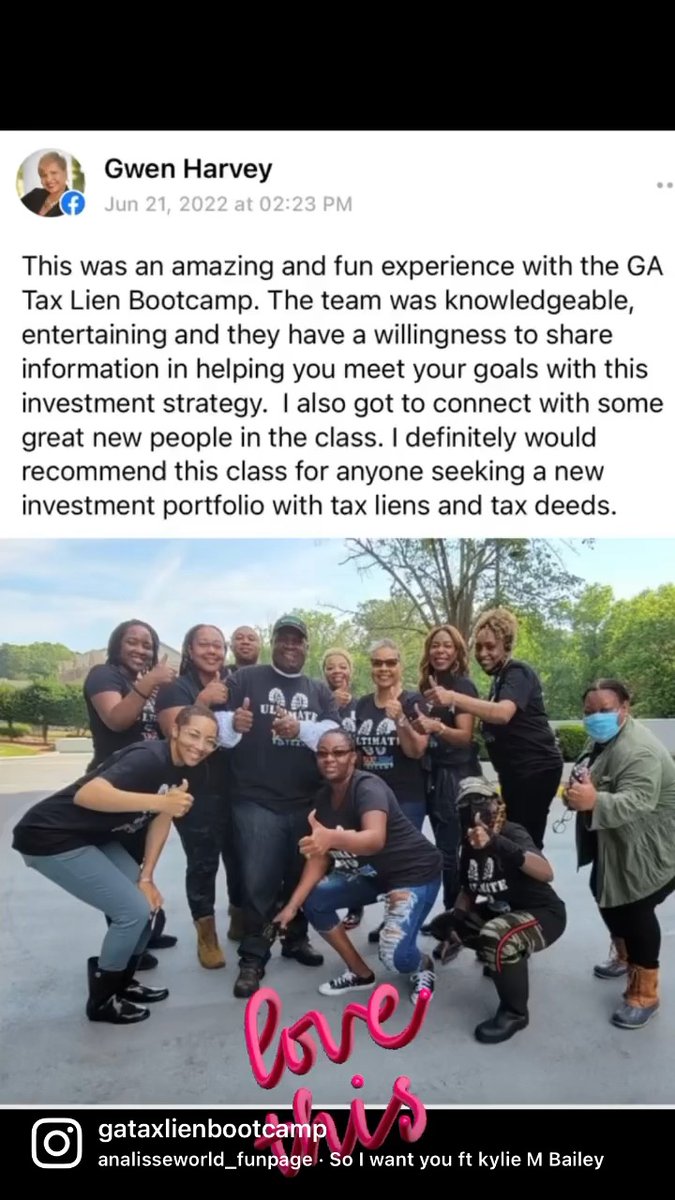

Ga Tax Lien Bootcamp Gataxlienbc Twitter

Atlanta Ga Commercial Foreclosures Listings

Georgia Property Tax Liens Breyer Home Buyers

Redeem A Non Judicial Tax Deed Gomez Golomb Law Office

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

Ga Tax Lien Bootcamp Home Facebook

Ga Tax Lien Bootcamp Educational Consultant In Atlanta

Ga Tax Lien Bootcamp Gataxlienbc Twitter

Ga Tax Lien Bootcamp Home Facebook

Ga Tax Lien Bootcamp Gataxlienbc Twitter

Ga Tax Lien Bootcamp Gataxlienbc Twitter

What Is A Tax Sale Property And How Do Tax Sales Work Home Buying Sale House Real Estate

Land For Sale In Atlanta Ga Sell Land In Ga Sh Consulting How To Buy Land Land For Sale Cheap Land For Sale

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

Ga Tax Lien Bootcamp Educational Consultant In Atlanta

1040 W Conway Dr Nw Atlanta Ga 7 Beds 9 Baths Atlanta Mansions Mansions Mansions For Sale